Condo Insurance in and around Raleigh

Here's why you need condo unitowners insurance

Protect your condo the smart way

Welcome Home, Condo Owners

Because your condo is so special to you, it makes sense to want to protect against the unexpected, which could include situations or damage due to smoke or wind. That's why State Farm offers coverage options that may be able to help protect your unit and personal property inside.

Here's why you need condo unitowners insurance

Protect your condo the smart way

Agent Alex Burt, At Your Service

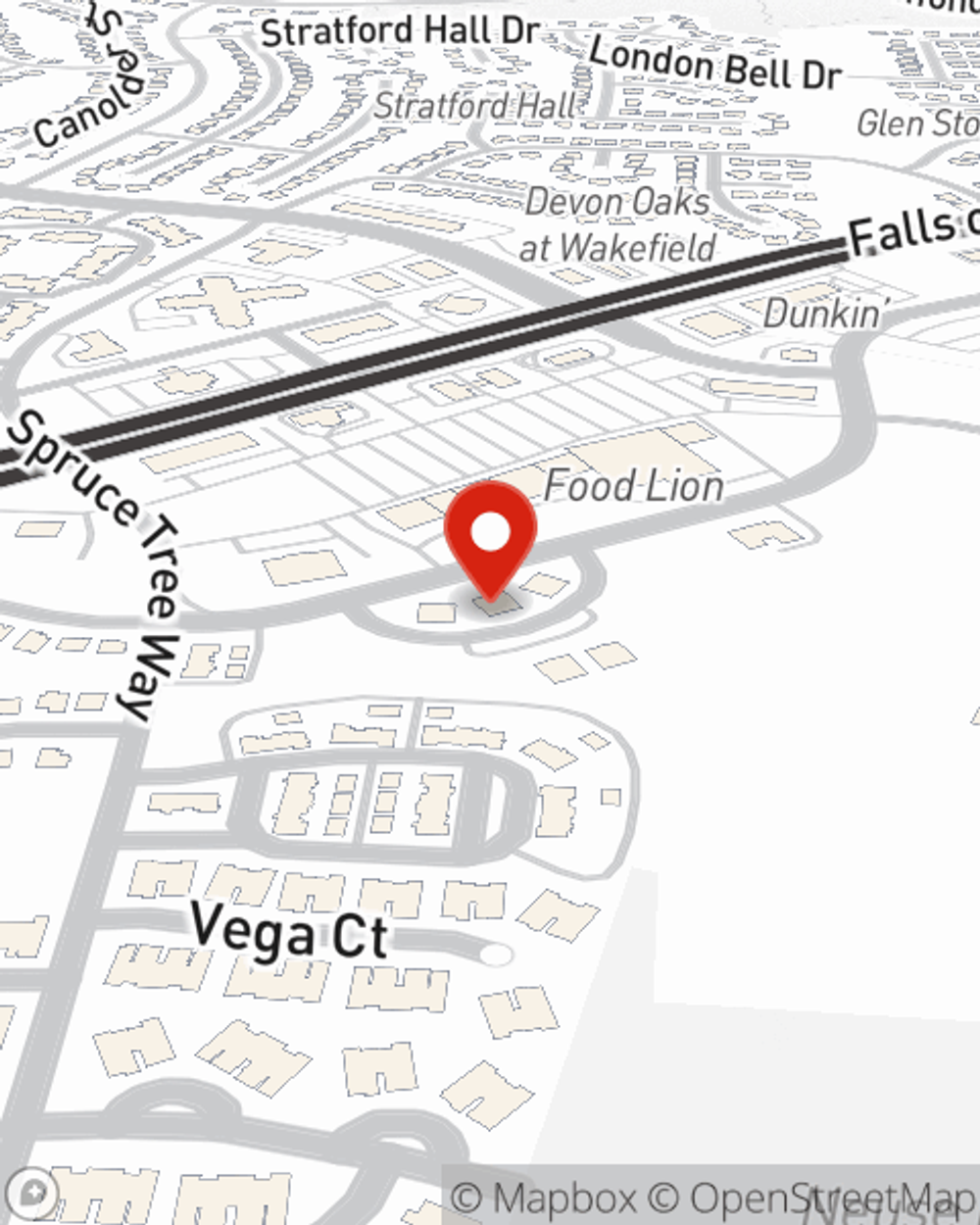

You can kick back with State Farm's Condo Unitowners Insurance knowing you are prepared for the unanticipated with dependable coverage that's right for you. State Farm agent Alex Burt can help you understand all the options, from bundling, liability to replacement costs.

Fantastic coverage like this is why Raleigh condo unitowners choose State Farm insurance. State Farm Agent Alex Burt can help offer options for the level of coverage you have in mind. If troubles like drain backups, identity theft or wind and hail damage find you, Agent Alex Burt can be there to assist you in submitting your claim.

Have More Questions About Condo Unitowners Insurance?

Call Alex at (919) 435-1417 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.